Crypto FOMO: The Psychology Behind Investment Decisions

Introduction

Fear of missing out (FOMO) has become a widely referenced motivator of cryptocurrency investment. This phenomenon, where individuals fear missing out on experiences or opportunities that others are enjoying, has been associated with various behaviors, including consumption experiences and investment choices

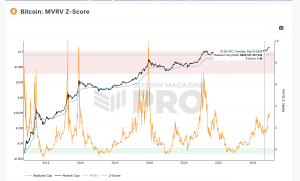

In the context of cryptocurrencies, FOMO has been linked to the rapid growth and volatility of the market, leading to significant price fluctuations and investor enthusiasm.

FOMO’s Impact on Cryptocurrency Investment

FOMO has been identified as a significant factor in driving investment decisions, particularly among younger adults. The fear of missing out on potential gains can lead to impulsive and emotional investment choices, often without a thorough understanding of the underlying risks and market dynamics. This can result in investors chasing trends and buying cryptocurrencies at peak prices, potentially leading to significant losses if the market reverses.

The Role of Financial Literacy and Risk Tolerance

While FOMO has been associated with investment decisions, it is not the only factor at play. Financial literacy and risk tolerance also play a crucial role in determining investment choices. Individuals with a higher level of financial literacy and a greater tolerance for risk are more likely to invest in cryptocurrencies, potentially mitigating the impact of FOMO.

Conclusion

In conclusion, FOMO is a significant psychological driver of cryptocurrency investment. It can lead to impulsive and emotional decisions, often without a thorough understanding of the underlying risks and market dynamics. However, financial literacy and risk tolerance also play a crucial role in determining investment choices. Understanding these factors can help investors make more informed decisions and manage their risk exposure in the volatile cryptocurrency market.