The Future of Bitcoin Mining: What Happens After All Coins Are Mined?

Bitcoin, the world’s first and most famous cryptocurrency, has sparked a revolution in digital finance since its introduction in 2009. One of its foundational processes is “mining,” a complex computational task that not only generates new bitcoins but also processes and secures transactions on the blockchain, Bitcoin’s underlying technology.

However, Bitcoin was designed with a finite supply of 21 million coins, leading many to wonder: What happens to Bitcoin mining when all coins are mined?

The End of New Bitcoins

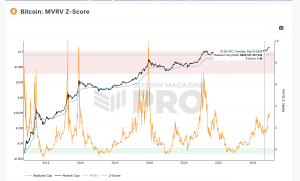

The creation of new bitcoins is set to end around the year 2140, due to the halving process, which cuts the reward for mining in half approximately every four years. This deliberate design choice by Bitcoin’s creator, Satoshi Nakamoto, mimics the scarcity and finite nature of precious metals like gold. As we approach this limit, the rewards for miners will continue to decrease, eventually reaching zero.

This raises the question: without the incentive of new bitcoins, what will motivate miners to continue their work?

Transition to Transaction Fees

The answer lies in transaction fees. Even now, alongside the block reward, miners earn fees paid by users to have their transactions processed and included in the blockchain. These fees vary based on transaction volume and network congestion.

As the block reward diminishes and eventually disappears, these fees are expected to become the primary incentive for miners.

The Role of Transaction Fees

Transaction fees are not a new concept; they have been part of Bitcoin transactions from the beginning. However, their role will become more significant in the future of Bitcoin mining. As the only source of revenue for miners post-2140, these fees will need to be substantial enough to compensate for the miners’ efforts and expenses, including electricity and hardware costs.

The expectation is that as the network grows and Bitcoin’s usage increases, the demand for transaction processing will rise. This increased demand will naturally lead to higher fees, ensuring that miners are still motivated to contribute their computational power to the network.

Security Implications

One of the critical roles of miners is securing the Bitcoin network. They do this by validating transactions and ensuring that there is no double-spending. As mining transitions from reward-based to fee-based, there have been concerns about the network’s security. However, the consensus is that as long as transaction fees remain sufficient to attract miners, the security of the network will be upheld. Moreover, advancements in mining technology and efficiency may also help offset reduced rewards.

The Evolution of Mining

As we move towards a future where all bitcoins have been mined, the mining process is expected to evolve. Miners may consolidate, leading to fewer but more powerful mining operations. There could also be shifts towards renewable energy sources, driven by the need to reduce costs and the growing societal emphasis on sustainability.

Conclusion

The cessation of new bitcoin creation will mark a significant transition for Bitcoin mining, but it does not signal the end. Instead, it represents a shift towards a new model where transaction fees become the main incentive for miners. This evolution ensures that despite the finite number of bitcoins, the network can continue to operate securely and efficiently.

The future of Bitcoin mining is not just about how many coins are left to mine but how the network adapts and grows, ensuring its place in the digital economy for years to come.