Analyzing the Possibility of Bitcoin Reaching a $1 Million Valuation

In recent discussions surrounding the future of Bitcoin, a prominent question has been whether it could realistically reach a valuation of $1 million per coin. This speculation isn’t just about optimism in the cryptocurrency world; it’s a debate that touches on the fundamental principles of market capitalization, investment shifts, and the comparative value of global asset classes.

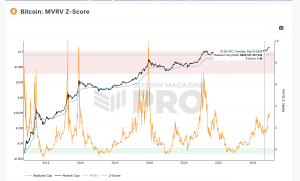

At its core, the argument against Bitcoin’s rise to a $1 million valuation rests on the enormous market capitalization this would imply. To put things in perspective, a $1 million price tag per Bitcoin translates to a total market capitalization of $21 trillion for Bitcoin alone. Considering the broader cryptocurrency market, this scenario would balloon the total crypto market cap to approximately $45 trillion.

Bitcoin vs S&P 500

For context, the combined worth of the companies listed on the S&P 500, a benchmark index representing the U.S. market’s health, stands at around $43 trillion. The idea that the cryptocurrency market could surpass this, or even equate, requires a significant leap of faith and a series of unlikely financial shifts.

One key argument is the need for a major devaluation of other asset classes, like the S&P 500, for such a monumental shift in value towards Bitcoin. This would mean investors moving trillions of dollars from traditional stocks and assets into cryptocurrency. Given the current financial landscape, this seems improbable. The kind of shift discussed here would require not just a change in investor sentiment but a fundamental reshaping of global financial priorities, possibly driven by massive inflation or a catastrophic event that undermines confidence in traditional assets.

$1 million, $10 million, $100 million

Another angle to consider is the sheer scale of such an increase. If Bitcoin were to reach $10 million per coin, its market cap would hit $210 trillion, roughly half the value of all world assets. At $100 million per coin, we’re looking at a market cap of $2,100 trillion, surpassing the total value of all assets globally by several magnitudes. These scenarios quickly venture into the realm of the absurd, highlighting the limitations of speculative optimism in the face of economic realities.

Therefore, the sentiment towards Bitcoin’s potential growth to $1 million per coin leans heavily towards skepticism. The financial mechanisms and market dynamics required to support such a valuation seem far-fetched under current and foreseeable conditions. While the cryptocurrency market has shown remarkable growth and resilience, the notion of Bitcoin reaching these astronomical valuations appears to be more of a theoretical exercise than a practical future possibility.

Where to go from here

In conclusion, while the cryptocurrency market continues to evolve and surprise, the likelihood of Bitcoin hitting a $1 million valuation per coin remains a distant prospect. The economic implications of such a valuation highlight not just the speculative nature of cryptocurrency investments but also the intricate balance of global financial markets. As with all investments, the future is uncertain, but the path to a $1 million Bitcoin faces significant financial and economic hurdles.