Bitcoin Whitepaper summary

In the financial world, the emergence of Bitcoin has been a significant event, marking a new era in the way we think about and handle money. For over a decade, Bitcoin, both as a digital currency and a network, has seen an exponential rise, capturing the attention of millions worldwide.

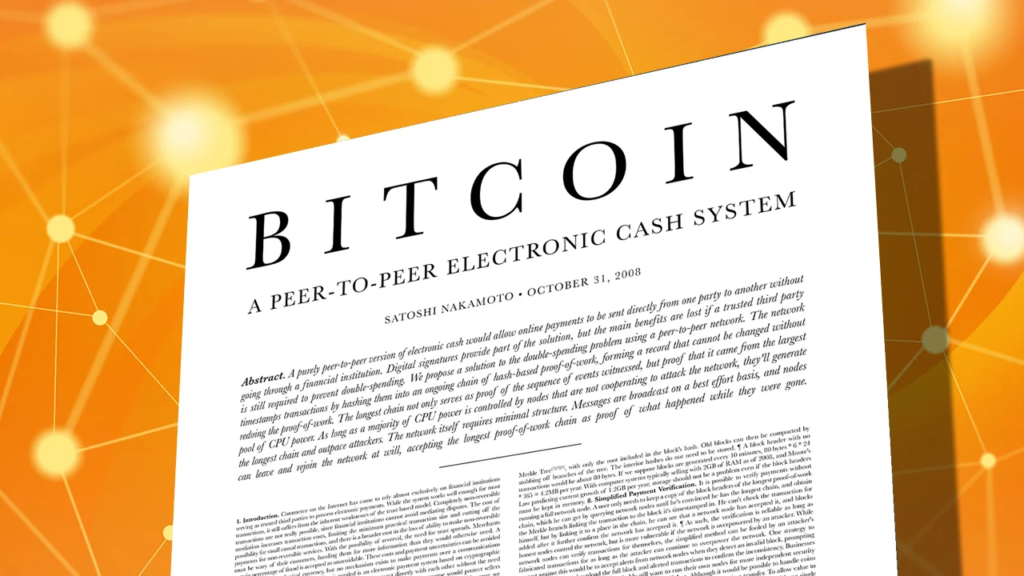

Yet, many of its enthusiasts are unaware of its origins, which can be traced back to a simple PDF document released on October 31, 2008. Titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” this document was a response to the Global Financial Crisis, introducing a monetary system that was limited in supply, completely decentralized, and tamper-proof.

The document, authored by an individual or group under the pseudonym “Satoshi Nakamoto,” leverages mathematical principles dating back to 1957 to lay the groundwork for today’s cryptocurrency. Despite its revolutionary impact, the true identity behind Nakamoto remains a mystery. This summary aims to distill the essence of the whitepaper, highlighting the key innovations and intentions behind Bitcoin, and providing a gateway to understanding the purpose and mechanics of this groundbreaking digital currency.

The Core Objective of Bitcoin

At its heart, Bitcoin was designed to revamp the traditional trust-based digital transaction model. Prior to Bitcoin, online purchases or credit card payments involved financial institutions as intermediaries, who authorized and executed transactions. Bitcoin introduced an electronic cash system that operates without the need for these third parties, enabling direct, peer-to-peer transactions that are secure, irreversible, and protected against fraud through cryptographic means.

Bitcoin aspires to embody the principles of sound money—serving as a medium of exchange, a unit of account, and a store of value. Satoshi Nakamoto imbued Bitcoin with attributes such as durability, divisibility, portability, intrinsic value, and scarcity, offering an alternative to conventional monetary systems.

The Mechanics of Transactions

The functionality of Bitcoin relies on the blockchain, a cooperative network where transactions are shared and verified by all participants. This process ensures that once Bitcoin is transferred, it cannot be claimed by the sender, facilitating a seamless and irreversible transaction process. The blockchain’s transparency allows anyone to access a public record of transactions, enhancing the system’s security and reliability.

Preventing Double-Spending

Double-spending, a potential flaw in digital finance where the same asset could be spent twice, is ingeniously countered in Bitcoin’s design. By requiring the verification of transactions by network nodes—computers connected to the blockchain—the system minimizes the risk of fraud. This widespread verification process strengthens as more nodes join the network.

The Role of Proof of Work

Proof of Work (PoW) is a mechanism that validates transactions and ensures their integrity. It involves solving a computational puzzle to secure each transaction within the blockchain. This process, known as mining, not only prevents tampering but also rewards participants with Bitcoin, incentivizing the maintenance and growth of the network.

Mining: The Incentive System

Bitcoin mining involves processing transactions and securing them into the blockchain, with miners rewarded in Bitcoin. This incentive ensures the network’s decentralization and operational integrity. The system is designed to operate under a majority rule, with a fixed limit of 21 million Bitcoins to be mined, ensuring the cryptocurrency’s scarcity.

Addressing Byzantine Faults and Privacy Concerns

Bitcoin’s blockchain technology offers a solution to the Byzantine Fault, a challenge in distributed systems where consensus is crucial but difficult to achieve. Through PoW and a democratic node voting system, Bitcoin ensures network agreement and security. Privacy, a major concern leading to Bitcoin’s development, is addressed by allowing users to transact without disclosing personal information, using only blockchain addresses for transactions.

Conclusion: The Legacy of the Bitcoin Whitepaper

Satoshi Nakamoto’s whitepaper concludes by reiterating Bitcoin’s ability to facilitate direct transactions without the need for third-party intermediaries, leveraging a peer-to-peer network that is transparent, secure, and resistant to corruption. Since its first transaction in January 2009, Bitcoin has challenged conventional notions of money, value, and trust, becoming a significant player in the global financial market.

As we delve into the intricacies of Bitcoin through this simplified exploration of its foundational document, it becomes clear that Bitcoin is not just a currency but a revolutionary technology that has the potential to redefine the financial landscape. For those interested in a deeper understanding, reading the original whitepaper is highly recommended.