The Evolution of Crypto Narratives: A Comprehensive Overview

Cryptocurrencies have been a subject of fascination and debate since their inception. The decentralized nature of these digital assets has led to the emergence of various narratives that have shaped the crypto market. In this article, we will explore some of the most significant narratives that have influenced the cryptocurrency space.

Decentralized Finance (DeFi)

One of the earliest and most influential narratives in the crypto space is the concept of Decentralized Finance (DeFi). This narrative revolves around the idea of a decentralized financial system that operates on blockchain technology. DeFi aims to provide a more efficient and inclusive financial infrastructure than traditional finance. The rise of DeFi has been a significant driver of the crypto market, with many projects focusing on building decentralized applications (DApps) and protocols that enable peer-to-peer financial transactions.

Artificial Intelligence (AI)

Another narrative that has gained prominence in recent years is the integration of Artificial Intelligence (AI) into the crypto space. The potential impact of AI technologies on various aspects of the industry, such as security, scalability, and user experience, has been a topic of much discussion. Many projects are exploring ways to leverage AI to enhance the functionality and usability of cryptocurrencies and blockchain platforms.

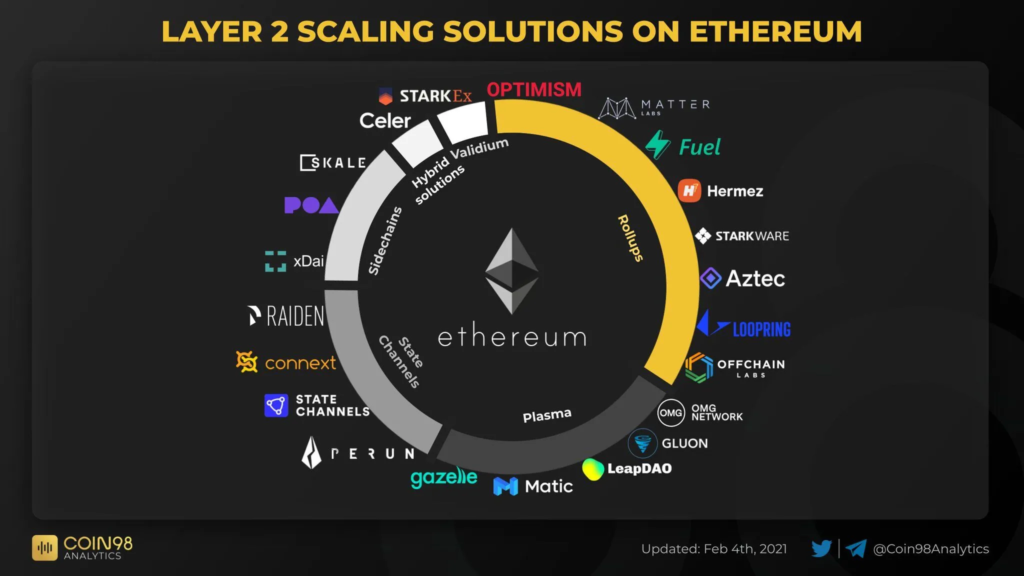

Layer 1 and Layer 2 Tokens

The narrative around Layer 1 and Layer 2 tokens has been a significant factor in shaping market dynamics and investor sentiment. Layer 1 tokens serve as the foundation for blockchain applications, while Layer 2 scaling solutions aim to address the scalability issues faced by many blockchain networks. The rise of Layer 2 tokens like Ethereum’s Layer 2 scaling solution, Optimism, has been a key driver of the crypto market, with investors showing increased interest in these projects.

Chinese Tokens

The narrative surrounding Chinese digital assets has seen fluctuations due to policy changes and economic injections in China. This has led to renewed interest in Chinese-associated coins like NEO, VeChain, and others. The Chinese government’s stance on cryptocurrencies has been a significant factor in shaping the market, with investors closely monitoring developments in this region.

Stablecoins

The narrative around stablecoins, assets pegged to fiat currencies, has surged in value recently. Stablecoins are seen as less vulnerable to price volatility, making them an attractive option for investors looking for a more stable investment. The rise of stablecoins like Tether and USD Coin has been a significant driver of the crypto market, with many projects focusing on building stablecoin-based ecosystems.

In conclusion, the crypto market is shaped by various narratives that influence public perception, market movements, and investor sentiment. Understanding these narratives is crucial for investors looking to navigate the dynamic crypto landscape effectively. As the industry continues to evolve, new narratives will emerge, shaping the future of cryptocurrencies and blockchain technology.