Understanding Bitcoin’s Fair Price

Bitcoin, the pioneering cryptocurrency, has captured the attention of investors and enthusiasts worldwide. One intriguing aspect of Bitcoin is its fair price calculation, a concept that sheds light on the intrinsic value of this digital asset.

Bitcoin’s Relationship with the Power Law Model

Giovanni Santostasi’s discovery of Bitcoin’s relationship with a power law model unveiled a unique characteristic of this cryptocurrency. When plotted on a log-log graph, Bitcoin’s price moves in a straight line, indicating a predictable pattern that sets it apart from traditional assets1.

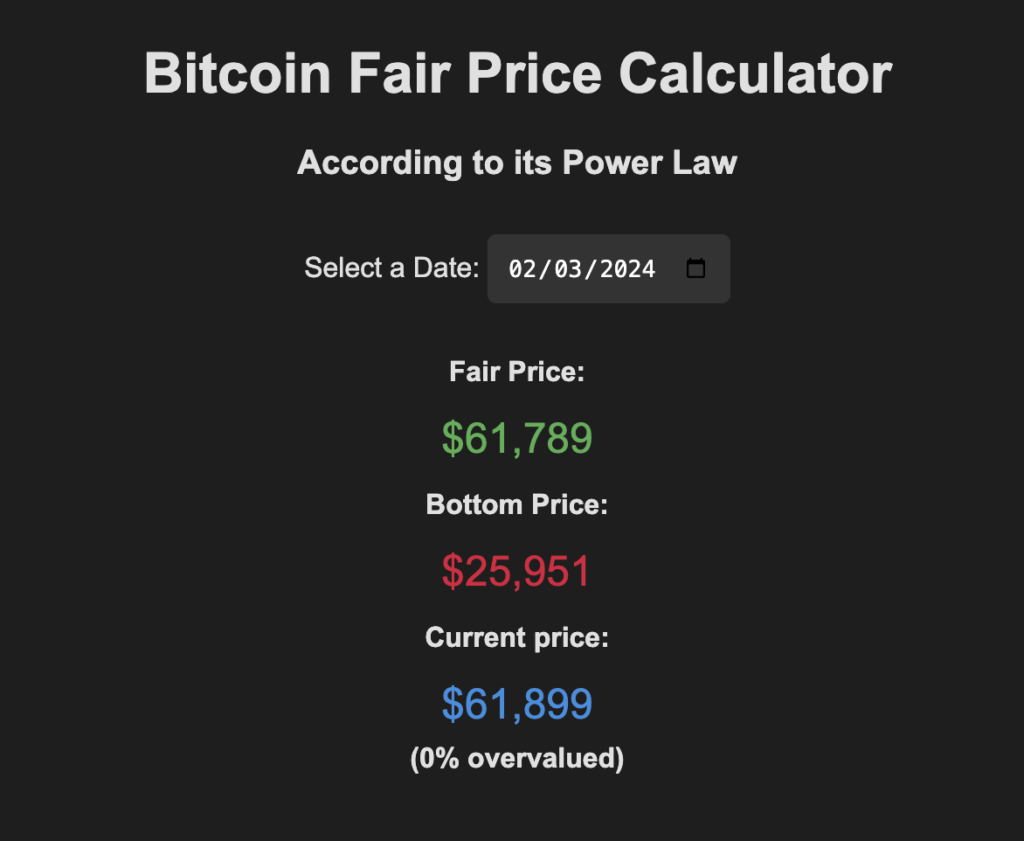

Fair Price Calculation

The fair price of Bitcoin is a crucial metric that helps investors assess whether the cryptocurrency is undervalued or overvalued. The fair price is determined using a formula that takes into account the number of days since the genesis block. This calculation provides insights into where Bitcoin’s price should ideally be based on its historical behavior

Significance of Bottom Price

In addition to the fair price, the concept of the bottom price plays a vital role in understanding Bitcoin’s valuation. The bottom price represents the threshold below which Bitcoin’s price is not expected to drop. It is calculated as a percentage of the fair price, offering a safeguard against extreme market fluctuations1.

Market Perspectives on Bitcoin’s Value

While the fair price model provides a structured approach to evaluating Bitcoin, market perspectives vary regarding its true value. Some sources suggest that Bitcoin’s fair value may be lower than what the market perceives, highlighting discrepancies in valuation methodologies4.In conclusion, Bitcoin’s fair price calculation offers valuable insights into the underlying dynamics of this digital asset. By understanding the relationship between Bitcoin’s price and fundamental metrics like fair and bottom prices, investors can make more informed decisions in this dynamic and evolving market.