Understanding Bitcoin Halving: A Golden Opportunity for Investors

Understanding Bitcoin Halving: A Golden Opportunity for Investors

The concept of Bitcoin halving is a pivotal element in the world of cryptocurrency, acting as a significant catalyst for the digital asset’s value and its broader ecosystem. For investors, both seasoned and novices, understanding the mechanics of Bitcoin halving, its implications, and the opportunities it presents is crucial for navigating the volatile yet potentially lucrative landscape of digital currencies.

What is Bitcoin Halving?

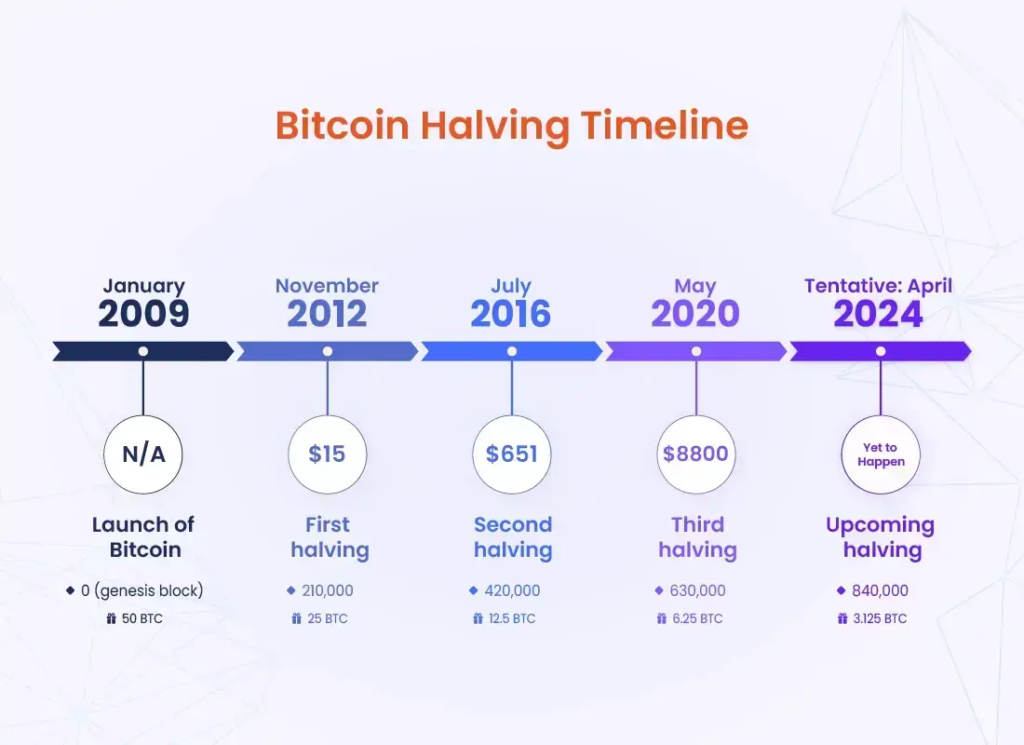

Bitcoin halving is an event that occurs approximately every four years, or more precisely, every 210,000 blocks mined on the Bitcoin network. This process is a core part of Bitcoin’s algorithm, designed to control the supply of Bitcoin and mimic the scarcity-driven value preservation similar to precious metals like gold. During a halving event, the reward that miners receive for validating transactions and adding them to the blockchain is cut in half.

Why does this matter? The halving event directly impacts the rate at which new bitcoins are created and enter circulation. This slowing down of supply growth is a deliberate mechanism to prevent inflation and to ensure that the total supply of Bitcoin caps at 21 million coins, making it a deflationary asset.

Implications of Bitcoin Halving

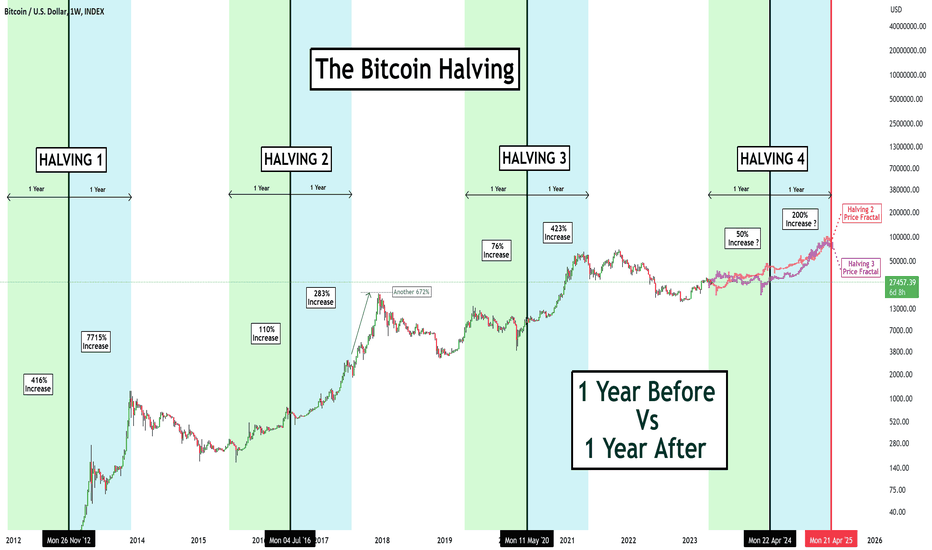

- Supply and Demand Dynamics: The fundamental principle of economics—supply and demand—plays a significant role here. As the rate at which new bitcoins are generated decreases, and assuming demand remains constant or increases, the price of Bitcoin has historically tended to rise. This is not a guarantee, but a pattern observed in past halvings.

- Increased Mining Difficulty: As rewards for mining decrease, some miners with higher operational costs may find it less profitable to continue mining. This can lead to a decrease in the network’s hashing power initially but is usually balanced out by the increasing value of Bitcoin and technological advancements in mining efficiency.

- Market Sentiment and Speculation: Halving events often lead to increased media attention and speculation, which can drive the price of Bitcoin up in anticipation of the event. Savvy investors monitor these cycles closely to make informed decisions on buying or selling Bitcoin.

Opportunities for Investors

- Long-Term Investment Strategy: For those with a long-term investment horizon, halving events can signal a buying opportunity. Investors who purchase Bitcoin before a halving and hold onto it can potentially see substantial gains as the market adjusts to the new supply rate and demand dynamics.

- Speculative Trading: More aggressive traders might leverage the increased volatility around halving events to make short-term gains. This strategy requires a good understanding of market sentiment and the ability to act quickly on news and price movements.

- Diversification: Bitcoin’s unique characteristics and its reaction to halving events offer an opportunity for investors to diversify their portfolio. Adding Bitcoin to a mix of traditional and alternative investments can enhance portfolio diversification and potentially increase returns.

Navigating the Risks

While the opportunities surrounding Bitcoin halving are compelling, investors must also be mindful of the risks. The cryptocurrency market is known for its volatility, and prices can swing dramatically in a short period. Furthermore, regulatory changes, technological advancements, and market manipulation can all impact Bitcoin’s price.

Conclusion

Bitcoin halving is a fundamental event that offers insightful opportunities for investors. By understanding the mechanics behind it and staying informed on market trends, investors can position themselves to capitalize on the potential benefits while managing the inherent risks. As always, due diligence and a balanced approach to investment are paramount to navigating the exciting yet unpredictable waters of cryptocurrency investing.