Bitcoin Halvings: A Bullish Trend with now shrinking Returns

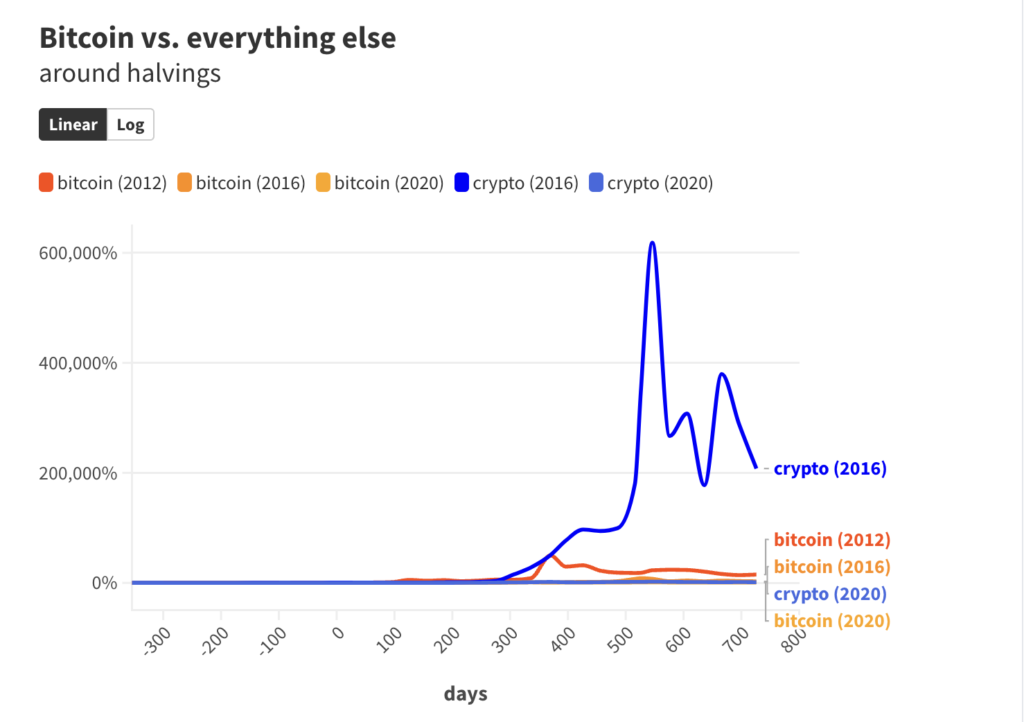

Bitcoin halvings, events where the reward for mining new bitcoins is halved, are often seen as catalysts for significant price growth. However, data from previous cycles shows that while individual cryptocurrencies may experience jumps in value during bull runs, the overall market has seen diminishing returns with each halving.

In simpler terms, as bitcoin’s market value has grown to over $1 trillion, it becomes increasingly challenging for its price to multiply at the same exponential rates seen in earlier years. This trend is evident in the percentage peaks observed after each halving:

- 50,000% one year after the 2012 halving

- 8,500% nearly one and a half years after the 2016 halving

- 1,000% one and a half years after the 2020 halving

While bitcoin remains a dominant force in the crypto market, with about half of the total market share, other cryptocurrencies tend to benefit more during bitcoin’s strongest rallies. For instance, during previous cycles, crypto excluding bitcoin saw substantial growth:

- From $64.9 million to $421 billion one year after the 2016 halving

- From $71.6 billion to $1.7 trillion one year before the 2020 halving

It’s essential to note that three halvings are too few to draw definitive conclusions about market behavior. Factors beyond halvings, such as global liquidity cycles, also play a significant role in shaping market trends.

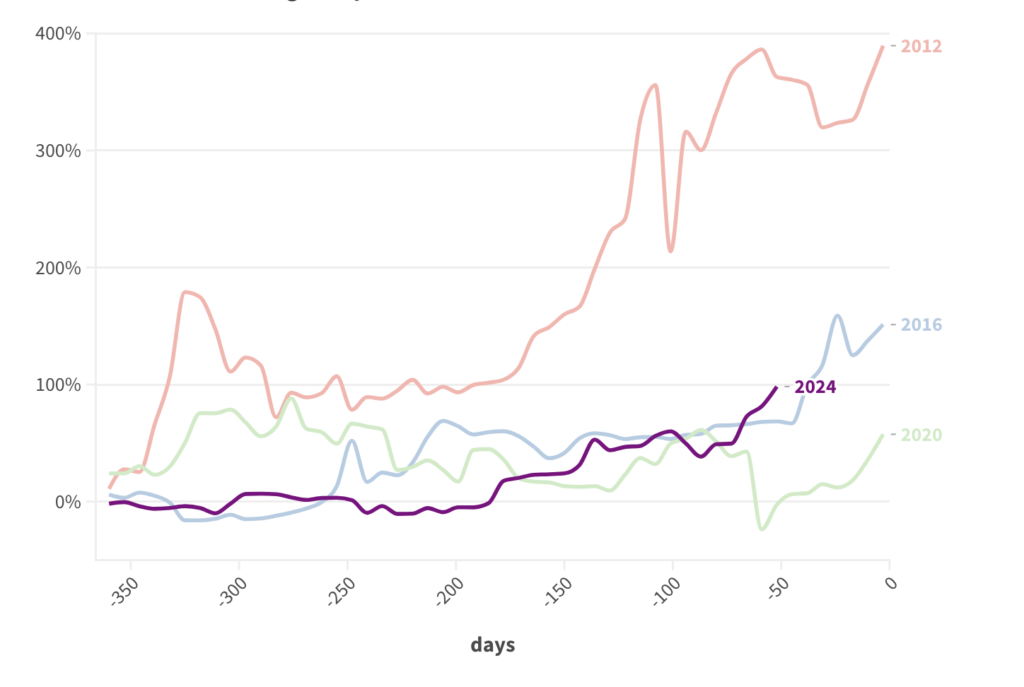

As we approach the upcoming halving expected on April 19 or 20, industry experts predict significant changes in bitcoin mining economics and price dynamics. While historical data can provide insights into potential price movements post-halving, it’s crucial to remember that past performance does not guarantee future results.

Despite the excitement surrounding bitcoin halvings, it’s evident that market cycles are evolving over time, with diminishing returns despite periodic capital injections.

As we navigate through these changes, understanding the broader market dynamics and staying informed about industry developments will be key for investors and enthusiasts alike.