Bitcoin’s Latest Trends: What Sets This Cycle Apart

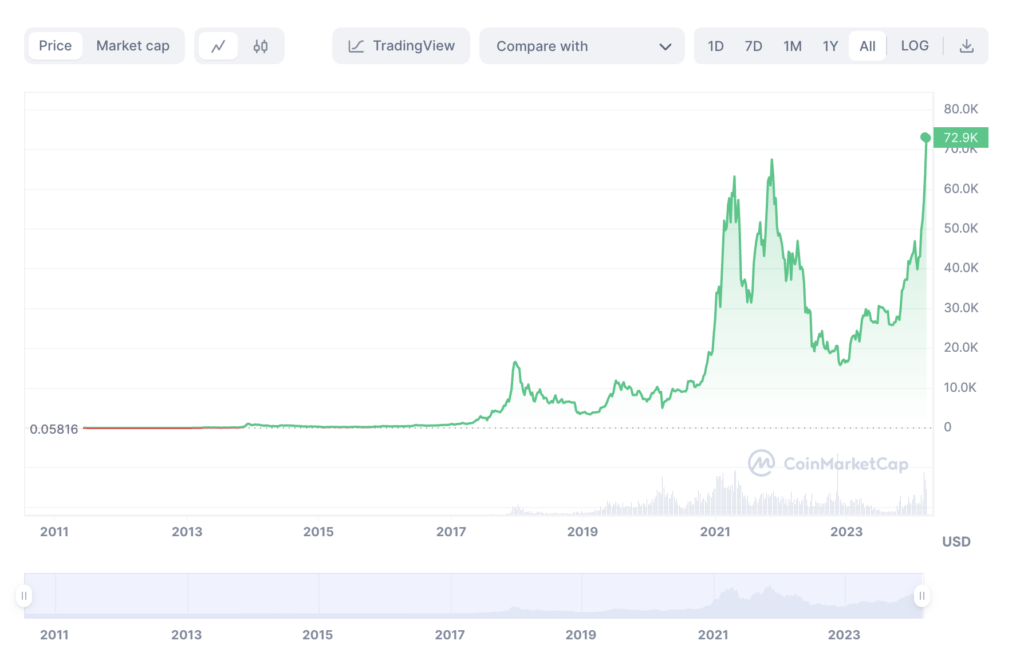

As we dive into the current phase of the cryptocurrency market, it’s clear that we’re witnessing a series of firsts that set this cycle apart from its predecessors. At the heart of these changes is Bitcoin (BTC), which has reached new heights never before seen in the lead-up to its scheduled halving.

Bitcoin’s Unprecedented Pre-Halving Peak

For the first time in its history, Bitcoin’s value soared to an all-time high before its much-anticipated halving event. This phenomenon can be traced back to two major factors. Firstly, the growing acceptance of the idea that Bitcoin’s value follows a predictable four-year cycle, culminating in a halving event, has turned this theory into a reality for many.

Secondly, the introduction of Exchange-Traded Funds (ETFs) into the cryptocurrency space has opened the doors to a new wave of investors. These investors, often more cautious and utilizing tax-efficient accounts like IRAs, have helped bolster Bitcoin’s dominance while tempering the growth of other cryptocurrencies, with the exception of Ethereum (ETH).

The ETF Effect

ETFs have introduced a fresh influx of investment, attracting a different type of investor to the cryptocurrency market. These individuals tend to be more conservative, investing through vehicles that offer tax advantages.

This shift has not only increased Bitcoin’s market share but has also led to a more subdued performance among alternative cryptocurrencies, barring Ethereum. It’s anticipated that this change in investor profile could result in less volatility in Bitcoin’s price over time.

The Stablecoin Scenario

An often-overlooked aspect of the current market dynamics involves stablecoins. Many providers of these cryptocurrencies are choosing to back their offerings with U.S. bonds, a move that has caught the attention of the Federal Reserve. Concerned with the implications for capital flow and market stability, the Fed is poised to take actions that could reshape the landscape of cryptocurrency investments.

The High Cost of Leverage

Another factor influencing the market is the cost of leveraging investments. The expense associated with borrowing, especially through decentralized finance (DeFi) platforms, has skyrocketed. Rates for borrowing stablecoins can reach up to 30% annually, with even higher costs for those employing significant leverage.

These exorbitant rates, combined with the risk of liquidation, have made high-leverage strategies unappealing to many investors. Furthermore, the opportunity to leverage Bitcoin through ETFs has not yet materialized, adding another layer of complexity to the market.

The Role of Retail Investors

Retail investors, or individual investors like many of us, have not participated in the run-up to Bitcoin’s all-time high with the same fervor as in previous cycles.

While more may join the fray after the halving, the elevated prices leading up to the event could dampen enthusiasm and potential returns, presenting a landscape that appears both costly and risky.

Looking Ahead

As we navigate this unique cycle, it’s evident that the cryptocurrency market is undergoing significant transformation. Bitcoin’s journey continues to ascend, albeit at a pace and under circumstances that diverge from past expectations.

Among the key takeaways are the anticipated reduction in market volatility, a more moderate increase in Bitcoin’s value post-halving, diminished returns from alternative cryptocurrencies (with the notable exception of Ethereum), decreased participation from retail investors, and a growing impact from governmental and traditional financial sectors on the crypto market’s direction and stability.

This evolving narrative underscores the dynamic and unpredictable nature of the cryptocurrency world, where each cycle brings new challenges and opportunities. As we move forward, keeping an eye on these developments will be crucial for anyone invested in the future of digital currencies.