Investment Opportunities in the Wake of COVID-19

The onset of the COVID-19 pandemic in early 2020 ushered in an era of unprecedented volatility across global financial markets. Traditional economic activities were disrupted, leading to massive fluctuations in the stock market and a surge in interest in alternative investments like cryptocurrencies. However, amidst this turmoil, astute investors found unique opportunities to grow their portfolios.

This article explores the diverse investment avenues that emerged during the pandemic and how investors capitalized on the changing financial landscape.

Stock Market Resilience and Growth

Buying the Dip

The initial market downturn was a cause for concern for many but also presented a lucrative opportunity for investors with a keen eye for value. Stock prices across numerous sectors plummeted, offering a chance to purchase shares at significantly lower prices. This “buy the dip” strategy allowed investors to acquire valuable assets at a discount, setting the stage for substantial gains during the market’s eventual recovery.

Spotlight on Tech and Healthcare

The pandemic highlighted the critical role of technology and healthcare sectors, which became the backbone of the new normal. Companies that facilitated remote work, digital commerce, online payments, and innovative health solutions saw their stock prices soar. Investors quickly recognized the long-term growth potential in these sectors, reallocating their portfolios to include firms that were pivotal in addressing pandemic-related challenges.

The Appeal of Dividend Stocks

In times of market volatility, the allure of dividend-paying stocks becomes even more pronounced. Investors gravitated towards companies with robust financial health and a history of consistent dividend payouts. These stocks offered a dual advantage: potential for capital appreciation and a steady income stream, making them a safe haven during the market’s uncertain phases.

The Cryptocurrency Boom

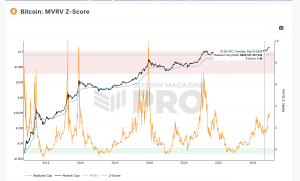

Bitcoin and Beyond: A Hedge Against Uncertainty

As the pandemic fueled concerns over inflation and the stability of traditional financial systems, cryptocurrencies like Bitcoin gained prominence as potential hedges. The appeal of digital currencies as a decentralized alternative to fiat money attracted both individual and institutional investors, driving up prices and market capitalization.

Institutional Adoption: A Vote of Confidence

The pandemic era saw an increase in institutional interest in cryptocurrencies. High-profile investments by companies like Tesla and Square not only bolstered the market but also lent an air of legitimacy to digital currencies, encouraging a broader spectrum of investors to explore crypto markets.

The Rise of Decentralized Finance (DeFi)

DeFi platforms emerged as a novel investment frontier within the cryptocurrency ecosystem. Offering services like lending, borrowing, and earning interest on crypto assets without traditional intermediaries, DeFi platforms provided new avenues for generating returns, attracting tech-savvy investors seeking to capitalize on the benefits of blockchain technology.

A Look at General Investment Trends

Benefiting from Low-Interest Rates

To mitigate the economic impact of the pandemic, central banks globally slashed interest rates, making borrowing more affordable. This monetary policy shift pushed investors towards the stock and crypto markets in pursuit of higher yields, fueling investment in various asset classes.

Stimulus Packages and Market Dynamics

Governmental stimulus efforts to support economies also played a significant role in shaping investment trends. With extra capital in hand, both businesses and individuals increasingly engaged in financial markets, contributing to the buoyancy of stocks and cryptocurrencies alike.

Embracing Market Recovery

Despite the initial shocks, financial markets demonstrated remarkable resilience, bouncing back stronger in many instances. This recovery underscored the importance of agility, thorough market research, and strategic diversification in investment decision-making. Investors who adapted quickly to the changing environment often reaped significant rewards.

Conclusion

The COVID-19 pandemic, while primarily a global health crisis, fundamentally altered the investment landscape, introducing both challenges and opportunities. It reminded investors of the importance of flexibility, the potential for innovation-driven growth, and the value of diversification. As we move forward, the lessons learned during this period will undoubtedly continue to influence investment strategies, highlighting the need for resilience and adaptability in the face of uncertainty.