Understanding Bitcoin’s MVRV Z-Score

The Bitcoin market can be volatile, with prices often soaring to new highs or plunging unexpectedly. For investors and enthusiasts alike, it’s crucial to identify whether Bitcoin is currently overvalued, undervalued, or fairly priced. One tool that has gained traction in this space is the Bitcoin MVRV Z-Score. By combining market data with statistical analysis, this metric provides a powerful lens for evaluating Bitcoin’s valuation relative to its historical trends.

What is the MVRV Z-Score?

The MVRV Z-Score is a financial metric that analyzes Bitcoin’s price cycles by comparing two key values:

1. Market Value (MV):

This represents the current total value of all bitcoins in circulation. It is calculated as:

2. Realized Value (RV):

Instead of valuing all bitcoins at the current market price, the realized value considers the price at which each bitcoin last moved on the blockchain. This gives a more realistic view of the network’s value by accounting for historical prices rather than just the present.

3. Z-Score:

The Z-score is a statistical measure that shows how far a particular data point is from the mean, expressed in terms of standard deviations. This helps highlight deviations from historical norms.

The MVRV Z-Score Formula

The MVRV Z-Score combines the above components into a single formula:

Where:

• Market Value is the standard deviation of the market value over time.

How to Interpret the MVRV Z-Score

The MVRV Z-Score gives a clear picture of market conditions, allowing investors to identify potential opportunities or risks:

• High Z-Score (e.g., above 7):

• This typically signals that Bitcoin is significantly overvalued compared to its historical trends.

• Such high values are often observed during market bubbles or euphoric phases.

• Low Z-Score (e.g., below 0):

• A low score indicates Bitcoin is undervalued, which often occurs during periods of fear or market capitulation.

• These conditions could present buying opportunities for long-term investors.

• Neutral Z-Score (around 0):

• A Z-Score close to 0 suggests that Bitcoin’s price is aligned with its historical average, indicating a fairly valued market.

Why is the MVRV Z-Score Important?

The MVRV Z-Score has several benefits for Bitcoin investors and analysts:

1. Identifying Market Tops and Bottoms:

• Historically, extreme Z-Score values have corresponded to market peaks (e.g., bull market tops) or bottoms (e.g., bear market troughs).

2. Timing Long-Term Investments:

• Investors can use the Z-Score to time their entries and exits. For example, buying during low Z-Score periods and selling during high Z-Score periods has been a profitable strategy.

3. Understanding Market Sentiment:

• By comparing the market value to the realized value, the Z-Score reflects the overall sentiment and behavior of market participants.

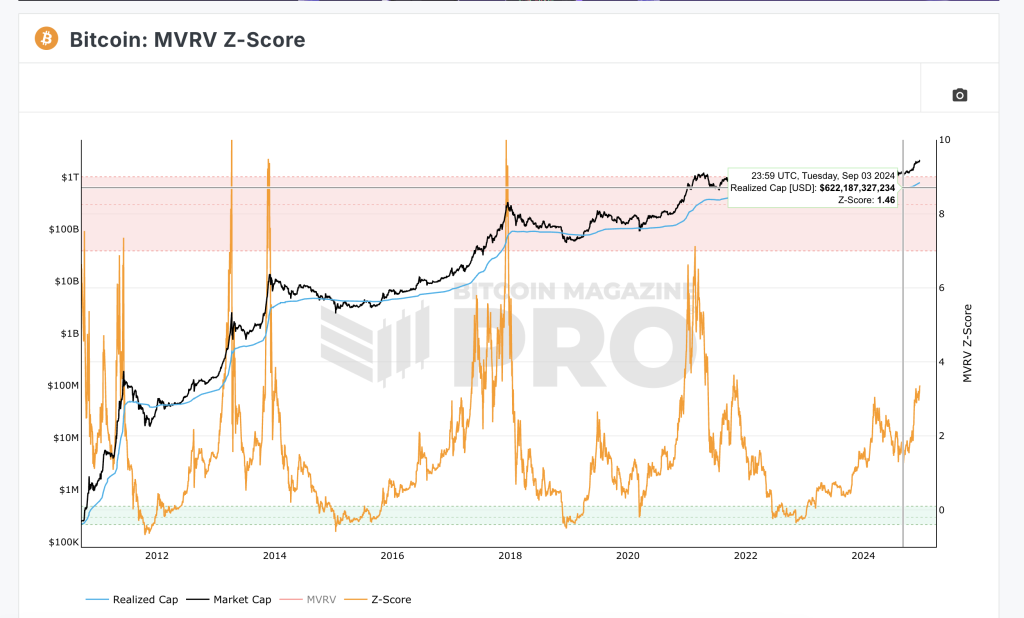

Where to View the MVRV Z-Score

You can view the current MVRV Z-Score and historical trends on Bitcoin Magazine Pro’s chart. This resource provides real-time updates, allowing you to track this metric and make more informed decisions.

Real-World Examples

1. Bitcoin’s Bull Run in 2017:

• During Bitcoin’s meteoric rise to nearly $20,000, the MVRV Z-Score soared above 7, signaling an overheated market. Shortly afterward, the price corrected significantly.

2. Bear Market in 2018:

• In late 2018, the Z-Score dipped below 0 as Bitcoin’s price dropped to around $3,000, marking an undervalued phase and a bottoming period.

3. 2021 Market Cycles:

• Similar patterns were observed in 2021, with the Z-Score spiking during bullish peaks and dropping during corrections.

Limitations of the MVRV Z-Score

While the MVRV Z-Score is a valuable tool, it is not foolproof. Investors should consider the following limitations:

• Not a Real-Time Indicator:

• The Z-Score works best for long-term trends and may not be effective for short-term price movements.

• Dependent on Historical Data:

• The metric assumes that past market behavior will repeat in the future, which may not always hold true.

For these reasons, it is best to use the MVRV Z-Score in combination with other tools and market analyses.

Conclusion

The Bitcoin MVRV Z-Score is a robust indicator that offers unique insights into market valuation. By comparing Bitcoin’s market value and realized value through the lens of historical trends, it allows investors to identify periods of overvaluation and undervaluation with statistical precision. While it is not a magic bullet, it can be a valuable addition to any investor’s toolkit when used alongside other metrics and market research.

For those looking to make data-driven investment decisions, the MVRV Z-Score can serve as a guide to navigate Bitcoin’s dynamic and often unpredictable market cycles. Stay informed and track the latest MVRV Z-Score data here.